Под управлением

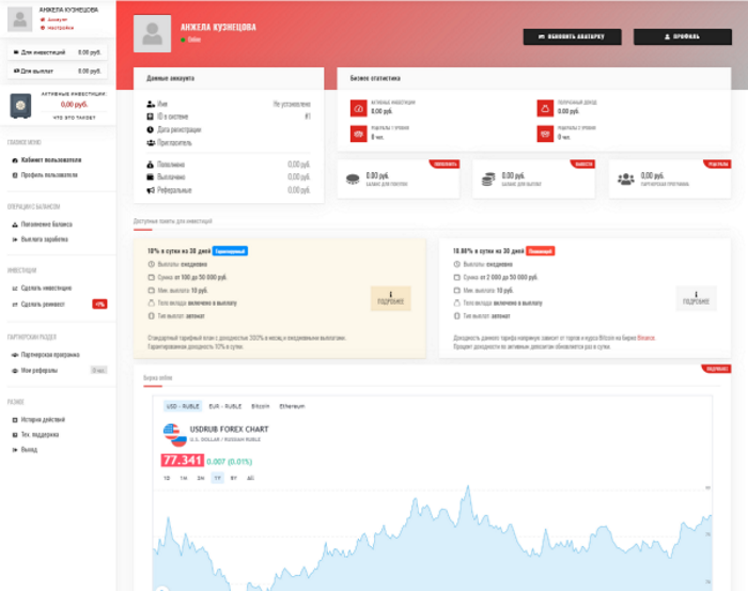

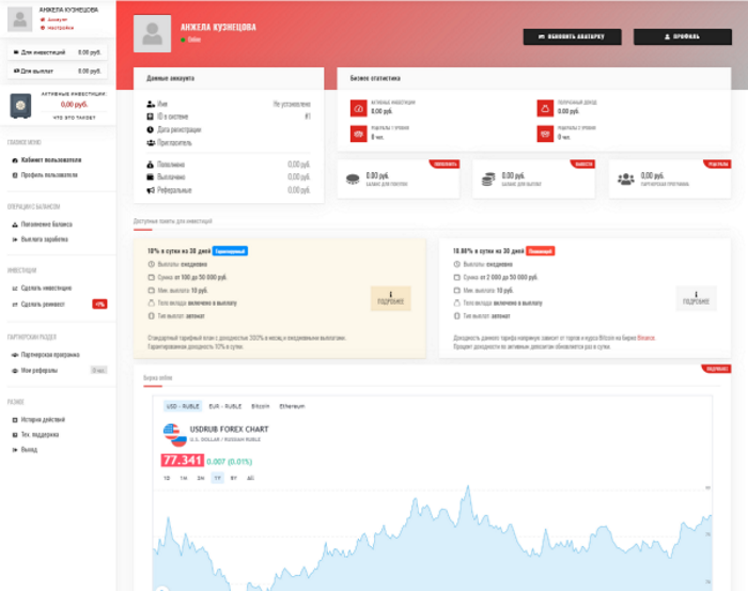

От регистрации до начала работы вклада не больше 10 минут. Вы получаете полностью рабочий инвест счёт.

Все операции на сайте - автоматические, с феноменальной скоростью обработки как выплат, так и пополнений.

Все открыто и доступно из личного кабинета, не нужно дополнительно подключать какие-либо метрики.

Мы будем уведомлять вас о состоянии ваших инвестиционных счетов и зачислениях на баланс

Наш сайт работает с большинством ПО и поддерживает комфортную работу с мобильных устройств.

Отвечаем быстро и круглосуточно, мы всегда поможем разобраться или дадим эффективные рекомендации.

Мы позаботились о безопасности ваших средств и прошли верификацию на платёжных системах проекта.

Никаких ограничений, требований, условий! Вся работа абсолютно прозрачна и регулируется регламентом.

Поощрайте своих рефералов автоматическими рефбек отчислениями и создавайте свою структуру.

В проекте проходят постоянные бонусы и конкурсы с денежными призами для всех активных инвесторов.

Простая и интуитивно понятная всем реферальная система позволит зарабатывать без вложений.

Сайт переведён на несколько языков и позволит работать инвесторам со всего земного шара.

Активация вклада происходит автоматически в течении 10 секунд с момента оплаты и получения информации с платёжной системы.

К сожалению, нет. Вы можете иметь только один аккаунт в проекте.

Регистрация самому себе рефералов - запрещена.

Техподдержка работает с 10:00 до 23:00 без выходных дней, за исключением крупных праздников.

Вы можете создавать любое количество вкладов в проекте и использовать их одновременно, получая прибыль.

Воспользуйтесь формой восстановления, для этого вам потребуется знать свой логин и e-mail в проекте.

Добавить - да, но изменить данные уже добавленных систем вы можете только через техническую поддержку.

Все финансовые операции в нашей системе выполняются полностью автоматически.

Реферальная ссылка доступна в личном кабинете проекта, в разделе со списком ваших рефералов и дохода с них.

Абсолютно нет. Порой даже один реферал может обеспечить стабильную прибыль на каждый день.

Вы можете делать реинвесты с любых средств в проекте в т.ч. с реферальных. Все делается в личном кабинете проекта.

Вы должны выводить средства на ту платежную систему, с которой проводили оплату.

Сразу, как только ваш реферал пополняет счёт в проекте. Вы можете их сразу выводить, либо создать вклад с этих денег.